Why Bitcoin is transformative

Bitcoin is transformative due to its unique combination of features that challenge traditional financial systems and enable new possibilities.

New uses of bitcoin continue to be creatively engineered. To help with understanding it's impact, some key concepts must be clarified.

The high-level architecture gives an adequate overview of the principles bitcoin exhibits.

Finally some applied uses in the world to introduce the transformation in action.

Emergence of pristine capital

Bitcoin has been described as the transformation of thermodynamic energy (electricity) into a global monetary network protocol without counter-party risks. The sheer power of the network, and the incentives of the deflationary system encourage a "savings technology" that also has no political risks, no local government regulation risks, no maintenance risks, no weather risks, no bad tenant risks, no product recall risks, no cash conversion cycle risks, no government overspending risks, etc...

It exists as a bank of time, that can be used as extremely low risk collateral.

Concepts of the network

- Nodes / Node Operators: these are the machines people run with the complete history of bitcoin stored locally. Low power machines are capable of storing this growing archive.

- Blocks: are linked together to form a chain of blocks. Blocks contain transaction data between one block and another. Blocks are created with a target time every 10 minutes on average.

- Mining: the automated/algorithmic process run on high performance equipment for solving a cryptographic puzzle to settle unconfirmed/unsettled transactions. The puzzle includes such data as:

- a random number (the correct random number solves the puzzle)

- the previous block summary (linking previous history with current history)

- the current set of unsettled transactions (transactions needing settlement)

- Consensus: all node operators agree the cryptographic solution provided by the winning miner is correct, and the race to find the next solution begins

- 1 bitcoin is divisible to 8 decimal places or 100,000,000 (one hundred million) satoshis.

- Where $1 is divisible to 1 cent $0.01

- 1 bitcoin is divisible to 1 satoshi 0.00000001

- Some people earn $35.37 per hour, others earn 0.00015234 btc per hour

- Proof-of-Work (PoW): computational work, mining.

- Game theory in Bitcoin refers to how incentives align participants to act in ways that strengthen the network, even if they’re self-interested. Key players and their incentives:

- Miners: They secure the network by solving computational puzzles to validate transactions and earn rewards (new bitcoins + fees). Honest mining is more profitable than cheating (e.g., trying to double-spend or attack the network) because:

- Cheating risks losing rewards and wasting costly computing power.

- The majority of miners must agree on the valid blockchain, so honest behavior is reinforced by the collective.

- Users: People use Bitcoin for transactions, store value, or speculate. As more users adopt Bitcoin, its value and utility grow, incentivizing holding or using it over alternatives.

- Node Operators: They run full nodes to verify transactions and enforce rules. While not directly paid, they ensure the network’s integrity, benefiting from a secure system they rely on.

- Developers: They improve Bitcoin’s code voluntarily, driven by reputation, ideology, or financial interest in Bitcoin’s success. Their work enhances the system for all.

- Miners: They secure the network by solving computational puzzles to validate transactions and earn rewards (new bitcoins + fees). Honest mining is more profitable than cheating (e.g., trying to double-spend or attack the network) because:

Architecture Principles

Decentralization

Bitcoin operates without a central authority (e.g., banks, governments), relying on a peer-to-peer network of nodes (15,000–20,000 in 2025) to validate transactions. This removes intermediaries, reducing reliance on trusted third parties and enabling censorship-resistant transactions.

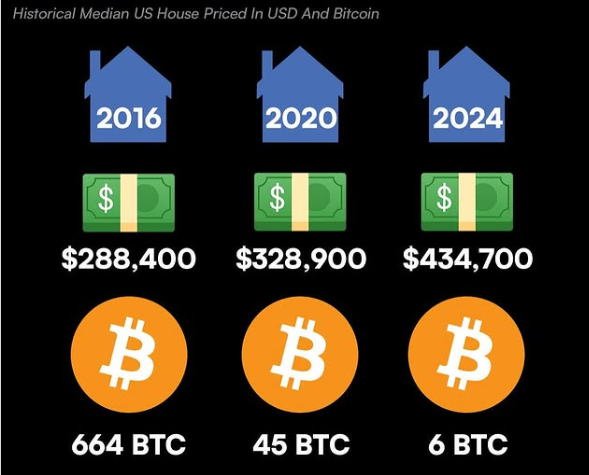

Bitcoin's Deflationary Design

Bitcoin’s supply is capped at 21 million coins, to be fully issued by 2140. An estimated 3–4 million bitcoins are already lost—permanently inaccessible due to misplaced private keys or destroyed wallets—further reducing the circulating supply. Every ~4 years (210,000 blocks), the issuance of new bitcoins halves, cutting the block reward for miners by 50% (e.g., from 6.25 BTC in 2020 to 3.125 BTC in 2024).

Unlike fiat currencies, which can be printed infinitely, or stocks and property, which face dilution or new supply, Bitcoin’s fixed cap and predictable issuance make it uniquely deflationary. As new issuance slows and lost coins accumulate, Bitcoin’s value may rise with sustained demand, positioning it as a hedge against inflation. By 2140, when no new bitcoins are created, miners will rely on transaction fees, further reinforcing its deflationary model.

Trustless System

Bitcoin’s proof-of-work (PoW) consensus mechanism ensures transactions are verified through computational work, not trust in institutions. The blockchain, a transparent and tamper-proof ledger, records all transactions, verifiable by anyone.

This trustless system eliminates the need for trusted intermediaries, reducing costs and risks of fraud or corruption in financial transactions.

Permissionless

Anyone with internet access can use Bitcoin, regardless of location, identity, or banking status. Wallets can be set up in minutes, and transactions can cross borders instantly without intermediaries.

By being permissionless, it enables financial inclusion for the unbanked (~1.4 billion people globally in 2025) and facilitates low-cost remittances (e.g., ~$700 billion in global remittances annually).

Most secure public network, immutability & resistance to censorship and seizure

Bitcoin’s blockchain is secured by immense computational power (hashrate ~600 EH/s in 2025, orders of magnitude more power than all of Microsoft, Google & Amazon combined), making it nearly impossible to alter past transactions. Its cryptographic design ensures secure ownership and transfers.

Bitcoin transactions cannot be easily blocked or seized by governments or corporations, as no single entity controls the network. Users control their private keys, securing their funds.

These properties protect against authoritarian overreach (e.g., asset freezes during political unrest) and preserves financial sovereignty.

Game theory & network effect

Unlike traditional competitive paradigms where one party’s gain often comes at another’s loss, bitcoin’s game theory and network effect create a system where participants — miners, users, developers, and node operators—benefit collectively.

Bitcoin’s game theory ensures participants’ self-interest strengthens the system, while its network effect makes it more valuable and secure as it grows. Unlike traditional competition, where winners take from losers, Bitcoin’s design aligns incentives so everyone benefits from collective success, challenging the zero-sum status quo.

The network effect is the idea that Bitcoin’s value grows as more people use it. Think of it like a phone network: one phone is useless, but millions of phones make it valuable because everyone can connect.

In bitcoin:

- More Users: Increase demand for Bitcoin, raising its price and making it a better store of value or medium of exchange.

- More Miners: Add computing power, making the network more secure and harder to attack.

- More Nodes: Enhance decentralization, ensuring no single point of failure.

- More Developers: Improve software, adding features like faster transactions or better privacy.

This creates a virtuous cycle: as the network grows, it attracts more participants, which strengthens security, usability, and value.

In traditional systems (e.g., banks or corporations), competitors fight for market share, often leading to zero-sum outcomes where one’s gain is another’s loss. Bitcoin flips this:

- Collective Benefit: All participants benefit as the network grows. Miners earn more if Bitcoin’s price rises due to user adoption. Users benefit from a more secure network as miners invest in computing power. Nodes and developers gain from a thriving ecosystem.

- Decentralized Trust: Unlike banks, which compete for customers and centralize control, Bitcoin’s decentralized design means no single entity dominates. Everyone has a stake in the system’s success.

- Incentive Alignment: Instead of undermining competitors, participants are incentivized to cooperate (e.g., miners follow rules, nodes verify, users transact), as their rewards depend on the network’s health.

Applications of a new paradigm

First scarce commodity with fixed supply

A commodity is a fungible asset, often produced or extracted through decentralized processes, traded in markets without a single controlling issuer, unlike securities tied to a specific entity.

Scarcity is easily described as the Mona Lisa & other esteemed art works, a 100 karat diamond, sea front real estate close to an economic hub, apartment block in a productive city (e.g. Manhattan). These are scarce because of their uniqueness - they are not fungible. Gold is fungible, and it is scarce because of the limted geological supply (on Earth, but maybe not on asteroids).

Bitcoin scarcity is set in the code that is validated by all node operators (some 15000-35000 nodes). The emission rate of newly created bitcoin follows this schedule until 2140.

Bitcoin emission of newly created coins simplified

- Approximately every 4 years, the emission is halved, starting from block 1 in 2009.

- Every 210,000 blocks, the coin emission is reduced by 50% (halved), starting with 50 new bitcoin created per block as the reward for spending electricity on solving the puzzle of transactions in that period.

- Each year there are approximately 52,500 blocks produced per year, at a frequency targetting 1 new block every 10 minutes.

- 144 new blocks per day.

- In 2025, it is currently the 5th iteration of the 210,000 block cycle. The initial cycle's 50 bitcoin reward created per block has been halved in:

- 2012 (25); and again,

- 2016 (12.5); and again,

- 2020 (6.25); and again,

- 2024 (3.125) currently in 2025

- Near term future schedule of reward having:

- 2028 (1.5625)

- 2032 (0.78125)

- 2036 (0.390625)

- 2040 (0.1953125)

- 2044 (0.09765625)

While bitcoin is not a natural resource, it mimics commodity-like scarcity through it's decentralized algorithmically enforced supply.

Applying daily emission with price & forecasting without additional adoption

- Historical approximate price range (in USD) for the entire day's accumulated block rewards (144 blocks per day)

- 2009: $7.20 per day (BTC price $0.001, 50 bitcoin per block)

- 2010: $7.20 - $2,808 per day (Low: $0.001, High: $0.39, 50 bitcoin per block)

- 2011: $2,088 - $136k per day (Low: $0.29, High $19.02, 50 bitcoin per block)

- 2012: $36k - $93k per day (Low: $5.00, High: $13.52, 50 bitcoin per block until November 28, reduced to 25)

- 2013: $46k - $4.075MM per day (Low: $13.02, High: $1,132, 25 bitcoin per block)

- 2014: ...

- ...

- ...

- 2022: $14MM - $43MM per day (Low: $15760, High: $47700, 6.25 bitcoin per block)

- 2023: $15MM - $39MM per day (Low: $16600, High: $44000, 6.25 bitcoin per block)

- 2024: $24MM - $47MM per day (Low: $39500, High: $106k, 6.25 bitcoin per block until April 19, reduced to 3.125)

- current 2025: $33MM - $54MM per day (Low: $75k, High: $120k, 3.125 bitcoin per block)

- In 20 years time (2045), the entire global bitcoin mining industry will be competing every targetted 10 minutes for (0.09765625 bitcoin) what is currenty priced at approximately $12,000 USD in Q3 2025

- Assuming the worst forecast of new bitcoin created per day remaining at current this year's highest bound ($54MM per day), 14.0625 bitcoin per day will be created, pricing bitcoin at $3,840,000 & at the lowest bound at $2.8MM per bitcoin. This assumption does not take into consideration any further adoption.

Adoption factors

- Hedge against inflation by companies already has started with bitcoin capital platforms, bitcoin treasury companies & leveraged bitcoin equities

- The U.S. spot bitcoin exchange-traded funds (ETFs) debuted in January 2024 and have become the most successful ETF introductions of all time. Since inception, they have attracted $50B of net inflows. Flows tracked at farside and also btcfundflow

- REITs + bitcoin have started appearing in 2025

Solving the double spend problem

Trust has been required for enabling long distant financial transactions since the times of Venetian bankers in medieval Europe. With the advent of digital systems and decentralized workflows like email, the double spend problem limited digital systems to continue to rely on trusted intermediaries.

The authenticity or validity of a payment could not be resolved until bitcoin provided the solution with a combination of cryptography & Proof-of-Work that was able to maintain the state of every unit that ever existed, ensuring a payment was not spent twice.

Renewable energy seekers

Renewable energy is cheaper. The cheaper the electricity, the cheaper the cost of production of new bitcoin. Bitcoin miners look for the cheapest electricity.

More importantly, renewable energy is unreliable for commercial use with peak demand not aligned with peak production. However, by being able to build out greater capacity, demand can align with moderate production. The excess is sold to bitcoin miners.

Most importantly, when there is high demand and the renewable grid is pushed beyond the limits, the agreements in place between energy providers & bitcoin mining facilities enable the provider to request the miners to turn off their machines for a designated period until demand reduces. This throttling is not possible with any other commercially viable system.

Recycling energy

The bitcoin mining equipment generates heat when running the computations. This heat re-use has been put into practice in several forms, where the heat was needing to be generated, but the cost of generating heat goes to generating bitcoin:

- Indoor space heaters at consumer level

- Heating for whole apartment blocks & neighbourhoods

- Green house nursury systems

Not only is the physical form of heat recycled, the Komodo Platform designed a system for low powered blockchain projects to re-use the bitcoin blockchain as a check pointing system, to increase the low powered chains security to bitcoin level security at a fraction of the cost.